Good Morning. Welcome to The Wire’s daily news roundup. Each day, our staff gathers the top China business, finance, and economics headlines from a selection of the world’s leading news organizations.

The Wall Street Journal

U.S. Imposes Visa, Export Restrictions on Chinese Firms and Executives Active in Contested South China Sea — The U.S. unveiled a set of visa and export restrictions targeting Chinese state-owned companies and their executives involved in advancing Beijing’s

LISTEN NOW

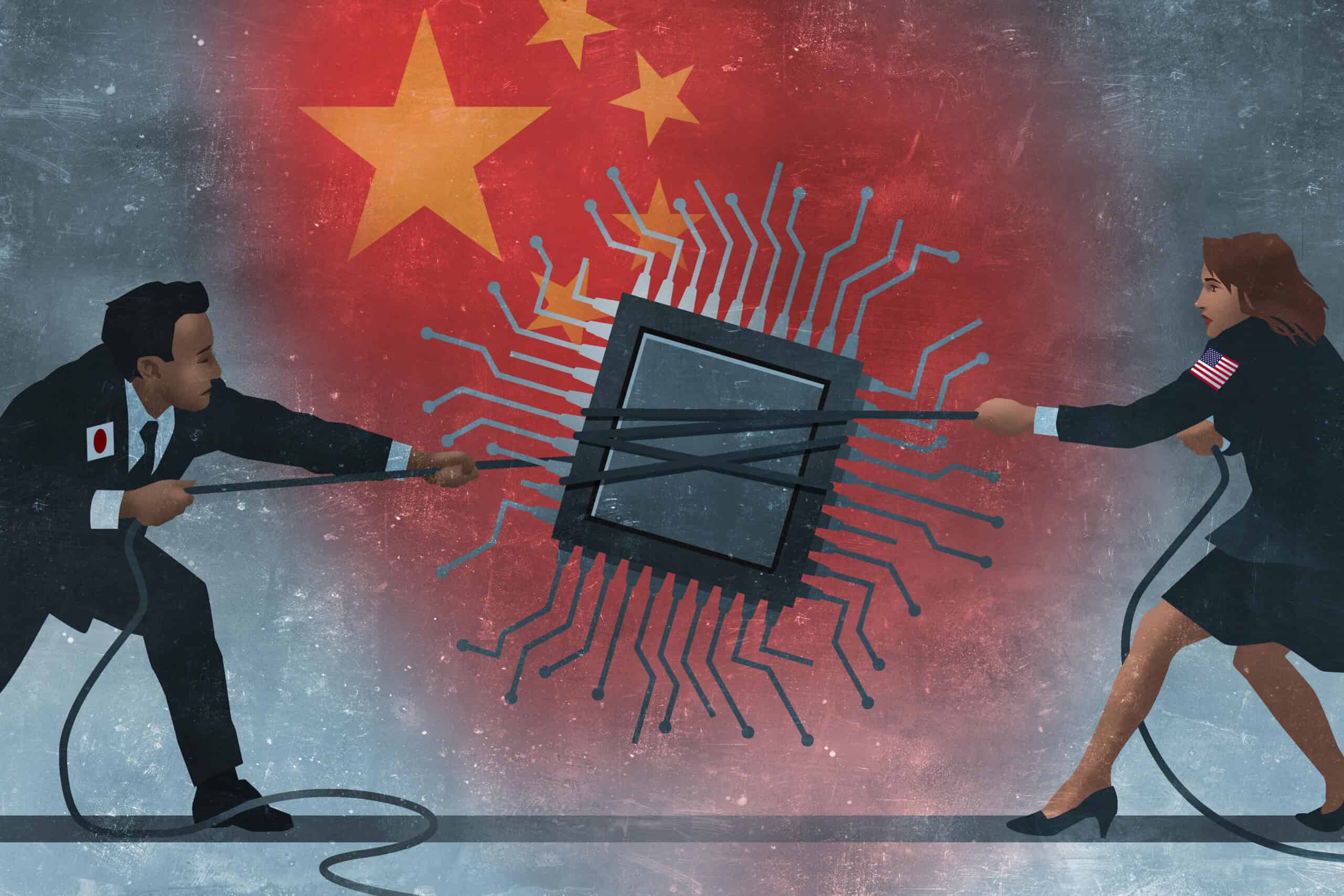

Face-Off: U.S. vs. China

A podcast about how the two nations,

once friends, are now foes.